The Daily Bag Protocol stands out in the decentralized financial (DeFi) landscape with its unique proposition of stability and attractive returns. It achieves this through its native token, $DBAG, which is pegged to the value of USDT, ensuring a constant value for users' rewards. This innovative approach, built upon the principles of its predecessor, the Olympus protocol, sets Daily Bag apart in the world of decentralized finance.

Key Features of the Daily Bag Protocol:

- Stability and Predictability: Similar to Olympus, Daily Bag aims to provide stability to its users by offering a token, $DBAG, which is pegged to the value of USDT. This peg ensures that users can confidently transact and hold $DBAG, knowing that their rewards' value remains constant.

- Fixed APY: One of the distinctive features of Daily Bag is its fixed Annual Percentage Yield (APY) pegged at a fiat level. Users are guaranteed an average APY of approximately 3000% (assuming the token price remains constant). This fixed APY offers users a predictable and attractive return on their investment.

- Treasury Management: The Daily Bag protocol operates its own treasury, which plays a crucial role in maintaining the stability and liquidity of the $DBAG token. The treasury comprises reserves in the form of $DBAG tokens. Inflows into the treasury occur when users purchase one of the protocol's three tiers (starter, standard, or premium), while outflows occur when users withdraw rewards from the protocol.

- Community Governance: Daily Bag is fully decentralized and governed by its community of token holders. Through on-chain governance mechanisms, stakeholders can propose and vote on changes to the protocol, including adjustments to treasury management strategies or protocol parameters.

- Financial Flexibility: Besides providing stability and attractive returns, Daily Bag offers users financial flexibility. Users can utilize $DBAG as a trusted asset, collateralizing other assets or depositing it into protocols' treasuries.

The Daily Bag protocol represents an evolution in decentralized finance, offering users stability, predictability, and financial flexibility through its innovative design and robust treasury management strategies.

Let's delve into the mechanics of the Daily Bag protocol:

- Three Plans: Users have the option to acquire one of three plans: Starter, Standard, and Premium, with respective costs of $100, $1000, and $10000. Users can acquire any of these plans multiple times to meet their desired investment amount. E.g. if a user wants to invest $300, he can do so by acquiring 3 Starter plans.

- Daily Allowance: Each plan offers a daily allowance equivalent to 10% (value modifiable by DAO) of the value invested, paid in $DBAG tokens, which are pegged to USDT. For example, if a user invests $1000, they are eligible to receive $100 as their daily allowance. If the value of $DBAG is $2, the user would receive 50 $DBAG tokens as their daily allowance.

- Random Factor: In addition to the fixed daily allowance based on the investment value, there is a random factor involved. The protocol starts with an initial success rate of 80% for receiving the daily allowance. This means that there is a 20% chance (value modifiable by DAO) that a user may not receive their daily allowance on a given day.

- NFT Mechanism: To increase the success rate from 80% to 100% for receiving the daily allowance, users have the option to acquire the protocol's Non-Fungible Token (NFT). This NFT is an ERC721 token with a total supply of only 1000. By acquiring and holding this NFT, users can ensure that they receive their daily allowance without any chance of failure. You can buy the NFT directly from OpenSea.

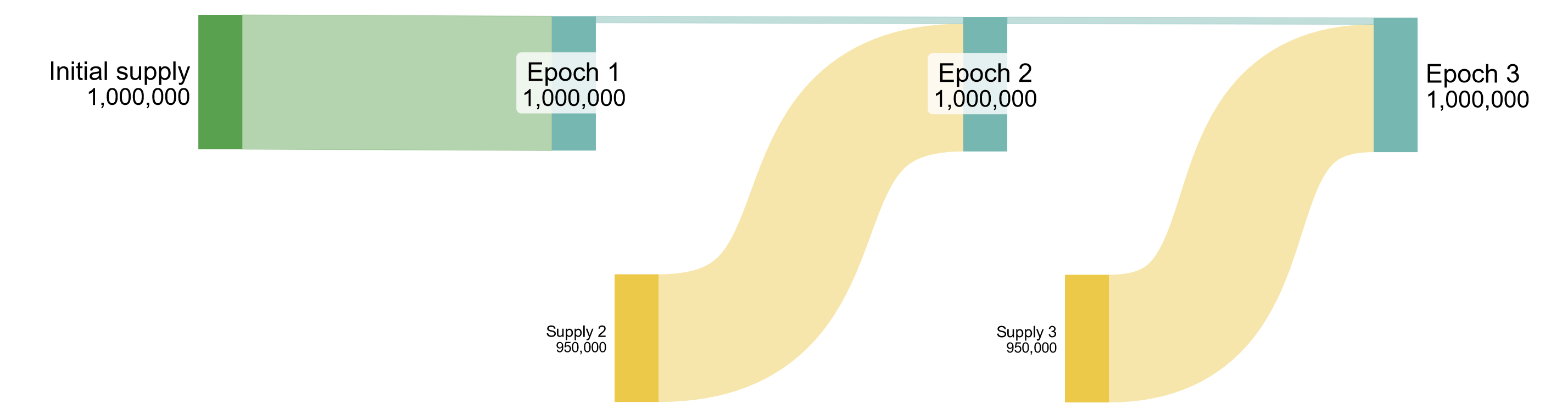

The concept of perpetual liquidity and the introduction of system epochs in the Daily Bag protocol fundamentally transforms its nature from a Ponzi scheme into a sustainable and continuously evolving system. Here's how:

Sustainability framework: By introducing perpetual liquidity, the protocol ensures that there is always a supply of $DBAG tokens available for users to claim, even after the initial treasury has been depleted. This prevents the protocol from collapsing once all tokens have been claimed, mitigating the Ponzi-like nature often associated with such systems.

Continuous Rebalancing: With the start of each new epoch, users are given the opportunity to claim a portion of the tokens from the old protocol epoch. This mechanism ensures that the protocol remains balanced and sustainable over time, as users are incentivized to continue participating in each new epoch to claim their share of tokens. This continuous rebalancing mechanism prevents the protocol from stagnating and provides ongoing opportunities for users to engage with the system.

Predictability and Transparency: The introduction of epochs brings predictability to the system, as users know that a new epoch will begin once the previous one ends. This predictability allows users to plan their participation in the protocol accordingly, enhancing trust in the system.

Action Incentives: From a game theory perspective, the perpetual liquidity mechanism incentivizes rational behavior among users. Users are motivated to participate in each epoch to claim their share of tokens, knowing that their rewards are directly proportional to their participation in previous epochs.

Perpetual liquidity and epochs are better described in the figure below:

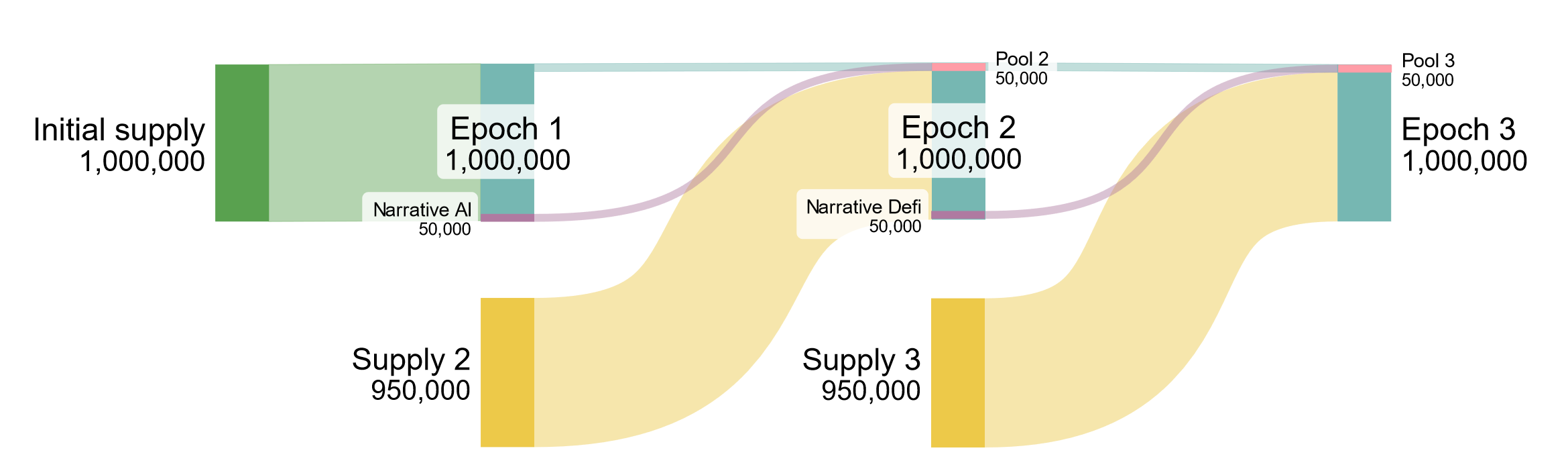

Introducing narratives as a feature in the Daily Bag protocol adds an innovative dimension to the ecosystem, providing a framework for community engagement. Here's how the narratives feature works:

Selection of Main Narrative: For each epoch, the protocol selects a central narrative to focus on. This narrative serves as a thematic focal point for the community and guides the allocation of resources within the protocol. For example, we selected the narrative "AI" in the first epoch. In subsequent epochs, via DAO Governance, users will choose among narratives like Depin, DeFi, Meme, Gaming, etc.

Investment Allocation: 10% of the fees collected during trading activities within the protocol is earmarked for investment in projects related to the selected narrative. These investments, strategically chosen to support the development within the chosen thematic area, play a crucial role in the evolution of the broader ecosystem.

Liquidity Pool Formation: The funds allocated for narrative-related investments are made available for liquidity pool formation upon the launch of the next epoch. This ensures that the resources collected from trading fees are productively used and contribute to the protocol's stability in subsequent epochs.

Here's the visual explanation of the narrative feature:

Introducing waiting times is a prudent strategy to prevent users from exploiting the system proposed by the Daily Bag. We aimed to avoid short-term speculation, encourage long-term commitment and reduce systemic risks (sudden influxes or outflows of funds which could disrupt the equilibrium of the protocol). Here's how these cool-off periods can effectively safeguard the integrity of our protocol:

Cool-off period after staking: By implementing a 7-day cool-off period (value modifiable via DAO) after staking their $DBAG tokens, users are discouraged from engaging in short-term speculative behaviour. This cooldown period incentivizes users to commit their funds to the protocol for longer, promoting stability and reducing the risk of sudden fluctuations in token supply.

Additional waiting after receiving the daily allowance: Extending the cooldown period by an additional 24 hours after receiving the daily allowance for both wallet claim and withdrawal adds an extra layer of protection against potential exploits. This waiting time is a buffer, allowing users to reflect on their actions, preventing impulsive rewards claiming or withdrawing staked $DBAG tokens immediately.

The Daily Bag protocol offers an easy-to-use affiliate program. There is no need to sign in with an email. After you connect your wallet to the dapp, you will see a strategically positioned link on the main page in the bottom right corner. Users are provided with personalized affiliate links to share with their networks. When someone purchases a plan through these links, the referring user receives 5% of the purchase amount credited to their address as in-game rewards. This program offers users a passive income opportunity and encourages active platform promotion.

The project is deployed on the Base chain.

$DBAG token contract - 0x...

$DBAG NFT contract - 0x3216cEA413065cF37462013A0c20CA406630F68B

Protocol contract - 0x...

The short answer is no, at least not in the traditional sense, although we must acknowledge that early investors will benefit the most from this protocol.

The long answer is this:

Arguably, life is a Ponzi. Throughout history, populations settled in fertile areas often experienced faster development and growth than those in less hospitable environments. For example, civilizations that emerged along the Nile River in ancient Egypt or the Tigris-Euphrates river system in Mesopotamia had access to fertile soil, abundant water sources, and favourable climates. These early settlements benefited from agricultural surpluses, trade networks, and technological advancements, giving them a competitive edge over neighbouring communities. This early advantage allowed them to accumulate wealth, power, and influence, akin to the initial investors in a Ponzi scheme who benefit from early payouts.

In nature, organisms that gain early access to resources or opportunities often have a greater chance of reproductive success. For instance, insects that fertilize eggs first may have higher reproductive rates, as they can monopolize mating opportunities and pass on their genes to future generations. Similarly, animals that establish territories or access to mates before others may enjoy increased reproductive success and offspring survival. This phenomenon reflects a competitive dynamic reminiscent of Ponzi schemes, where early participants benefit disproportionately compared to latecomers.

Early colonizers or pioneer species often play a critical role in shaping the environment and paving the way for subsequent species in ecosystems undergoing ecological succession. For example, lichens and mosses are among the first organisms to colonize barren habitats such as volcanic rocks or sand dunes. Their presence helps stabilize soil, retain moisture, and create microhabitats suitable for other plant species. As these pioneer species establish themselves and modify the environment, they create opportunities for more complex and diverse communities to thrive. This process of ecological succession mirrors the dynamics of Ponzi schemes, where early participants lay the groundwork for subsequent growth and expansion.

Here are a few ideas that separate the Daily Bag protocol from a Ponzi scheme. Unlike Ponzi schemes, which rely on deception and unsustainable financial practices, the Daily Bag Protocol operates transparently, clearly outlining its mechanisms and functionalities to users. It describes how rewards are generated, distributed, and accessed, fostering trust and credibility among participants. Integrating the perpetual liquidity and time epochs mechanisms solves the finality problem. Moreover, the protocol demonstrates a commitment to continuous development. It evolves, integrating new features, functionalities, and improvements based on user feedback and market dynamics.

Last but not least, there was no presale, KOL involvement, or token airdrops. The Daily Bag was deployed as a stealth launch. The initial sell pressure is nonexistent because virtually nobody owns the tokens except for the protocol contract (92.5%), the LP (5%), and the dev (2.5%).